As banks are tightening up their lending criteria and people look at doing Property Developments it is becoming more common for two or more parties to undertake a development together.

Sometimes this involves two or more parties as part of the deal.

It could be one person contributing the land and another party undertaking the development. Or it could involve three or four parties joining together to purchase land and undertake the development.

Structuring in these type of transactions are critical both from a legal perspective, asset protection perspective and tax perspective.

A common question is then well how do we structure this ?

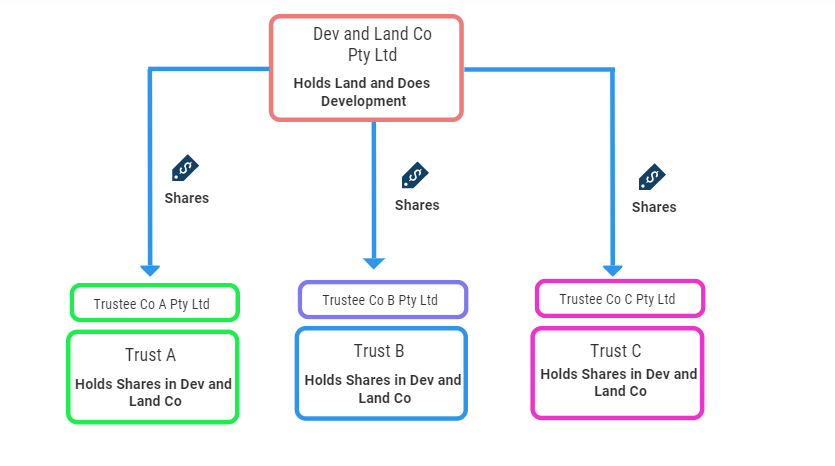

A structure I commonly see is represented below

During the development phase and sale phase this all seems to work nicely as the profits will be taxed at 25% (assuming Dev and Land Co Pty Ltd is a base rate entity)

But the issue that frequently arises is the distribution of profits on sale.

It is common for the parties to want access to the profits soon after sale so they can go their separate ways.

The issue we have however is from a tax perspective.

In order for the company to distribute the profits to the shareholders it will need to pay a dividend.

Until the company has paid tax however it may not have sufficient franking credits to pay out a fully franked dividend.

I have seen some accountants suggest to prepay instalments to generate franking credits.

However s 205-20(3) ITAA 1997 states that “the requirement in paragraph (a) means that the entity cannot generate franking credits by making a “voluntary” payment of income tax (that is, paying an amount on account of income tax for which the entity is not liable at that time when the payment is made”

So in order to get the funds out it means that until a dividend can be paid the funds would have to be loaned. This creates a potential Division 7a issue.

From a tax perspective , the company may pay a fully franked dividend even if it does not have sufficient franking credits.

However, the company would be liable to pay franking deficit tax (FDT) if its franking account is in deficit at the end of an income year. This means, if the company pays a franked dividend on or before 30 June it would incur a franking deficit tax.

The amount of FDT payable is the amount of the company’s franking deficit at that time.

A franking account tax return must be completed and any FDT liability paid by the last day of the month immediately following the end of the company’s income year.

FDT can be offset against the company’s income tax.

However, where the deficit at the end of the year is more than 10% of the franking credits that arose during the year, the company’s franking deficit tax offset may be reduced by 30%.

The 30% offset reduction does not generally apply in the first income year in which a private company has an income tax liability. This concessions allows a private company to make franked distributions in its first taxable year without incurring a penalty. One of the conditions that must be met is that the amount of the income tax liability for the relevant year is at least 90% of the amount of the deficit in the company’s franking account at the end of the income year.

So as you can see it’s not simple.

It could well mean the company can’t be wound up as the parties wished until these things are finalised.

In another blog we will discuss an alternative structure that may be more suitable when parties are doing a “joint venture” together.