I'm Doing a Property Development. How Should I Structure It ?

I recently had the pleasure of presenting at one of Bob Andersen’s “The Property MasterMind” seminars in Melbourne Property Development Courses: Be A Developer – Property Mastermind

One of the questions that is frequently asked is “How Should I Structure my Property Development ?”

Is there business structure for property developments that is the best ?

As i mentioned in that seminar each persons circumstances are different and what might be right for one property development project might not be the most suitable for the next one.

So lets’ dive in with a few diagrams and see how you might consider structuring your development

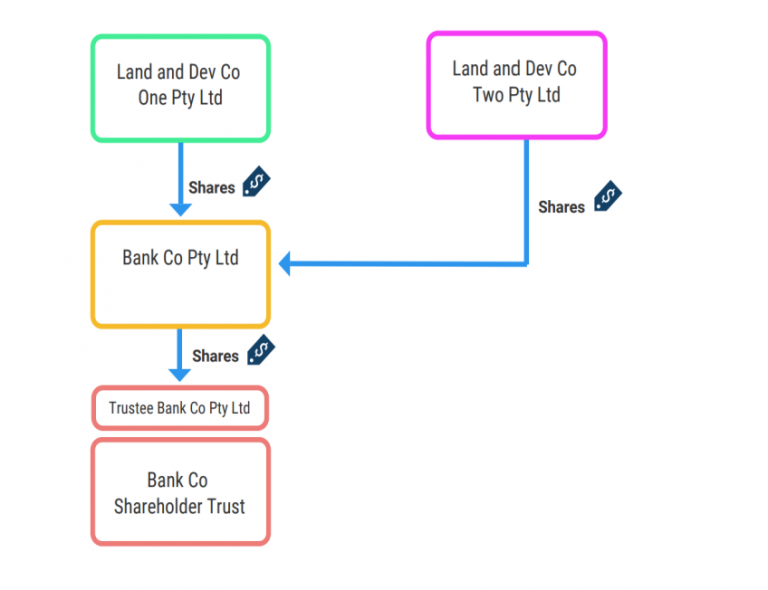

Structure One - Company - Property Development

- A developer could hold the land and undertake the development through the one entity.

Although this involves a lower setup cost (i.e. you have one entity holding the land and undertaking the development) if

the development entity is sued then the landholder is also exposed.

ADVANTAGES

1. Lower setup costs as opposed to having the land and development company in two seperate entities.

2. Profits and cash after selling the development can be distributed through to Bank Co Pty Ltd (without any additional tax being paid) and provide a level of asset protection by holding the cash in a seperate entity.

3. Loans for future developments can be made by Bank Co Pty Ltd to another Development Company (a Pty Ltd) without Division 7a issues.

4. Distributions can be made from Bank Co Pty Ltd via a dividend to the shareholder being Bank Co Shareholder Trust and then to the beneficiaries of the shareholder trust.

5. Potential land tax savings compared to a discretionary trust, sometimes referred to as a family trust, in some States.

DISADVANTAGES

1. Land Asset is exposed as the development is being undertaken by the same entity.

In this structure we have a company in its own right that will acquire the land, undertake the development and sell the completed product.

This will allow you to pay tax of 25% on your profits compared to the top individual tax rate of 45% (excluding the Medicare levy). That is a saving of 20%. A real return on your investment.

A disadvantage of this structure is that if the entity accumulates profits and has cash as well it provides an asset protection risk if that entity was to be sued.

The shares in the company are many times held by a corporate trustee for a discretionary trust. However in this structure we have a company in its own right holding the shares in the development company.

This allows the development company to pay a fully franked dividend to the shareholders being another company and move the cash from the development company to the shareholder company.

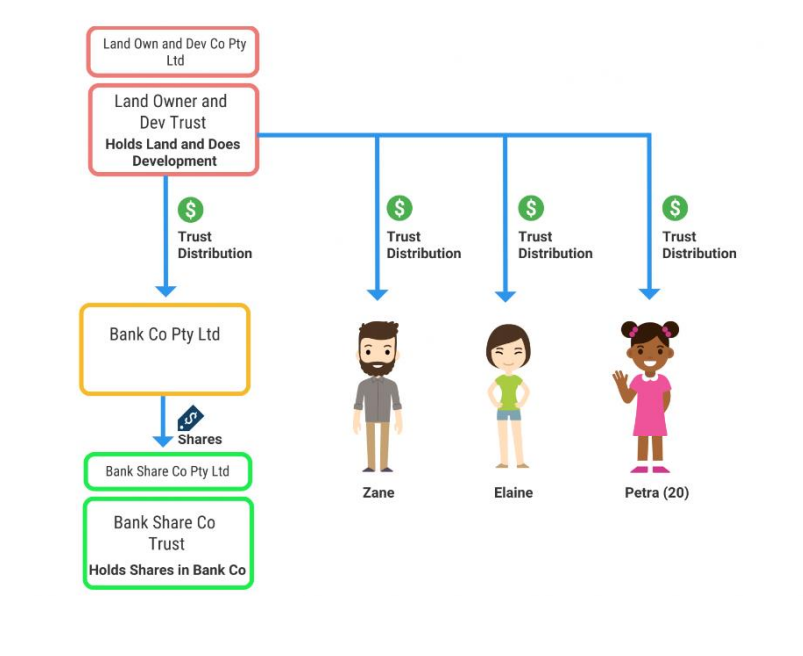

Structure Two - Discretionary Trust - Property Development

In this structure we have a discretionary trust (many times it is referred to as a family trust) with a corporate trustee.

The discretionary trust will acquire the land, undertake the development and sell the completed product.

Once the development is completed and a profit is made we then need to consider who are the beneficiaries of the trust and who we should distribute to.

In our example we have Zane, his partner Elaine and their 20 year old adopted daughter Petra as members of their family group.

We would first look at making distributions to achieve a “group” tax rate of 25% where possible.

If Zane and Elaine are earning more than $45k but less than $120k then they will be paying 32.5% so this might not be a major issue if they are seeking to extract funds for private purposes.

However any income earned over $120k to $180k will push them into the 37% tax bracket. And anything over $180k straight into 45%. These rates are where planning can become critical.

So for this development we could decide to distribute nothing to Zane and Elaine and distribute $20k to Petra so she can pay her university fees, accommodation at the university and the running costs of a small car her parents purchased for her.

Now one thing that has become really important with distributing to children over the age of 18 is a thing called Section 100A.

It’s a complex provision and could be another blog in itself but basically if you distribute to a child over 18 and they don’t see the funds you are going to have a problem.

But in this example Petra actually receives the $20k and uses it for her education purposes.

The remaining profit could then be distributed to a company. Sometimes this is called a “bucket company” or “bank company”

The advantage of distributing to this entity is that the distribution will be taxed at 25% providing the trust was undertaking development activities and no more than 80% of its assessable income for the year of income is base rate entity passive income.

We need to consider actually making the distribution to the company or we will need to consider Division 7a if the distribution isn’t made.

What many developers do is to distribute the profits to the company and use this entity as a bank for future development activities.

Many developers use this strategy to reduce their overall income tax.

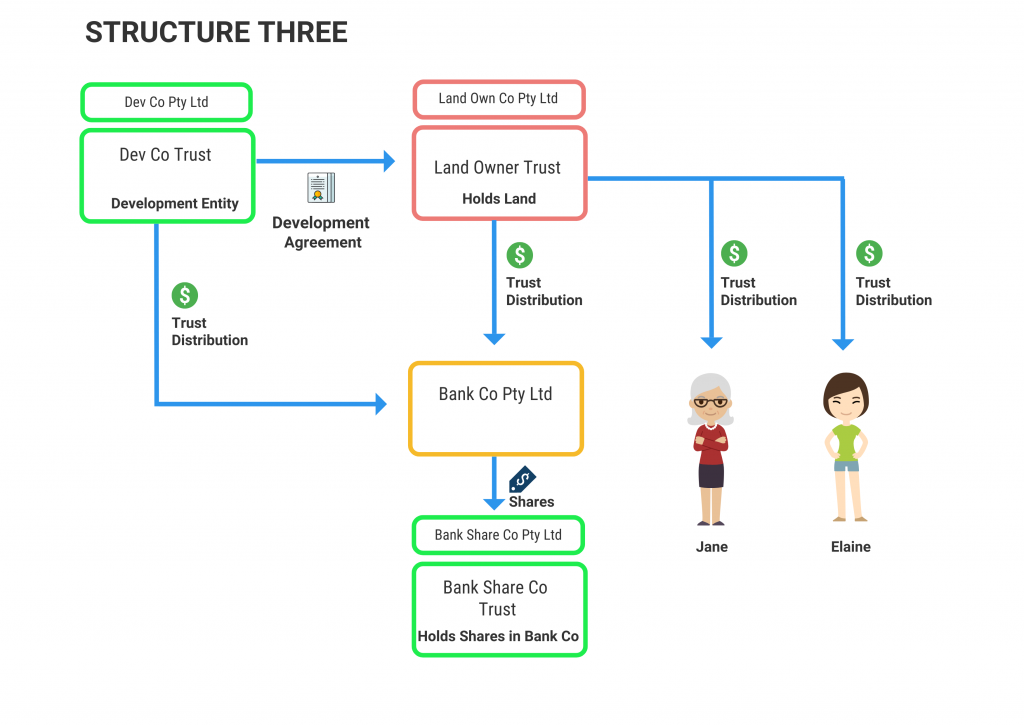

Structure Three - Development Entity and Land Holding Entity -Property Development Business

This structure is a lot more complex but separates the development risk from the land holder.

We have a separate entity (in this case a trust but it could well be a company as well) that holds the land.

Another entity undertakes the development activities. It hires subcontractors, purchases materials, markets and sells the completed the properties held by the land holder.

The landholder enters into a development agreement with the development company to undertake these activities.

In this example we can then consider distributions to be made by both entities similar to the distribution strategies considered above.

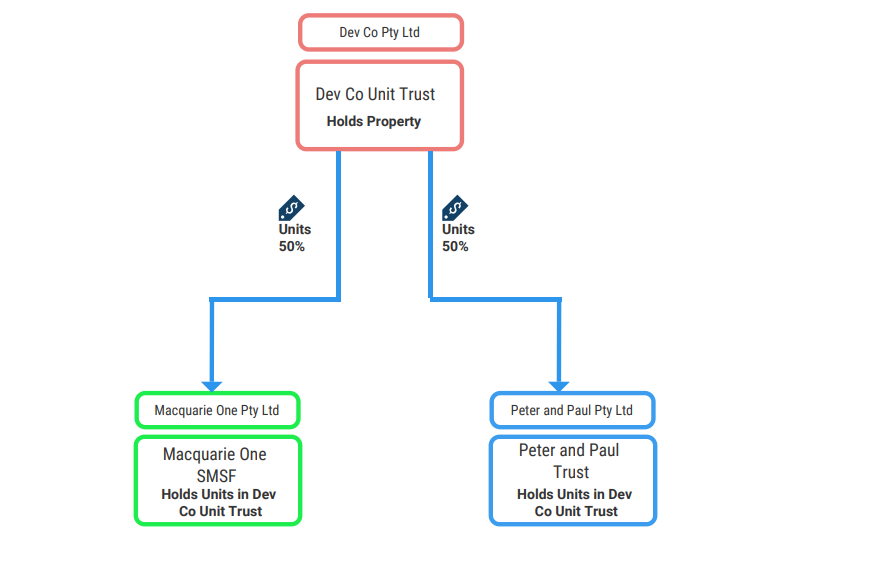

Structure Four - Doing a Development with Others

When doing a development with other parties it is worth considering a Unit Trust to undertake the development.

Unit Trusts are a common investment vehicle where multiple owners are involved.

Many people are familiar with company structures where the shareholders own shares in a company and have an indirect interest in the assets of the company.

With a unit trust the unitholders indirectly own their proportionate interests in the property held by the unit trust.

Once profits are made from the development the profits are then distributed to each unit holder.

Involving an SMSF - Unrelated Unit Trust

Many people would like to use their SMSF as part of a property development.

A structure where an SMSF does not hold more than 50% of the units in the unit trust, and where the other unitholders are unrelated parties could be considered.

Under this arrangement the unit trust is then allowed to borrow funds to complete the development and the in-house asset rules will not apply.

Frequently Asked Questions

There is no one-size-fits-all answer to this question. The best business structure for property development will depend on your individual circumstances, the nature of your property development project, and your financial objectives. You might consider options such as operating through a single entity, separating landholding and development activities into different entities, or using a unit trust when multiple owners are involved. Each structure comes with its own advantages and disadvantages which should be carefully considered.

A Discretionary Trust, often referred to as a Family Trust, is a structure where a trustee holds and manages assets for the benefit of beneficiaries, who are usually family members. In the context of property development, a Discretionary Trust can be used to acquire land, undertake development, and sell the completed product. This structure allows for tax planning flexibility, as profits can be distributed to different beneficiaries in the most tax-efficient way.

The main advantage of separating the landholding and development entities is risk management. By holding the land in one entity and conducting development activities in another, you can protect the landholding entity from the potential financial risks associated with the development process, such as lawsuits or financial losses.

A Unit Trust is an investment structure where unitholders indirectly own their proportionate interests in the property held by the unit trust. It is commonly used when a property development involves multiple owners. Profits from the development are distributed to each unit holder, according to their share.

It’s possible to use your SMSF as part of a property development, but it’s crucial to follow the appropriate rules and regulations to avoid penalties. One potential structure could involve an Unrelated Unit Trust where your SMSF holds no more than 50% of the units and the other unitholders are unrelated parties. Under this arrangement, the unit trust can borrow funds to complete the development, and the in-house asset rules will not apply. However, it’s essential to seek professional advice when considering this option.

Hi Michael,

Bob Andersen here. I’ve said it privately and now I will say it publicly. Thank you for being so generous with your time and knowledge in sharing your wisdom on common structures used for property developments.

This is such a critical component of a successful development and a timely one for many of the attendees. I highly value knowledgeable professionals and you are certainly an essential member of my property development ‘A Team”.