GST and the Margin Scheme - The Ultimate Guide

The margin scheme may assist in reducing the GST payable on the sale of real property.

The rules provide an alternative method of calculating the GST on sale of property.

GST and Property

When it comes to GST and Property Transactions it is probably one of the most complex areas of the GST Act.

The first thing that you need to determine when analysing your property transaction is whether

(a) the sale of the property is in the course or furtherance of an enterprise that you are carrying on ; AND

(b) if so, whether you are registered for GST or required to be registered for GST.

Step One – Does GST apply to the sale ?

Section 9-5 of the GST Act, provides that a supply is taxable if it is

(a) made for consideration

(b) made in the course of furtherance of an enterprise carried on by the entity making the supply

(c) connected with Australia; and

(d) made by an entity registered or required to be registered.

Additionally, section 23-5 of the GST Act provides that you are required to be registered for GST if

(a) you are carrying on an enterprise ; and

(b) your GST turnover meets the registration turnover threshold.

Step Two – Are you eligible to use the margin scheme ?

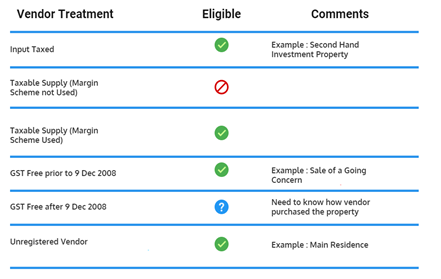

This is critical and the rules can be extremely complex particularly where the property has been sold GST free.

The table below will help in determining whether you might be able to apply the margin scheme on sale. It depends on the GST treatment when you purchase the property from the vendor.

Step Three

Did you and the purchaser agree in writing before settlement that the margin scheme would be applied to the transaction ?

This doesn’t necessarily have to be in the sale contract but it is extremely important that the agreement to use the margin scheme is in writing.

Many people confuse the ‘margin’ for GST purposes with the ‘profit on sale’. The margin for GST purposes does not include other costs that are included in calculating the profit such as subdivision costs, construction costs, etc.

CAUTION

The vendor is responsible to the ATO for any potential GST liability. If the ATO determines that GST is payable during audit it is the vendor who will be responsible for this payment.

This is one of the reasons for ensuring that advice on GST is sought.

Many legal advisers will include a clause within the contract to recover GST from the purchaser if it is discovered that GST is payable.

Legal advice is imperative when preparing contracts for sale to ensure that any GST risks are addressed and mitigate prior to the completion of sale.

Peter purchased some land in 2019 for $500k from a private vendor who was not registered for GST or required to be registered for GST.

Peter paid $3k in legal fees on acquisition and $15k in stamp duty.

He developed two townhouses and sold the two properties for $1.5m. He paid agent’s fees for selling the properties of $35k and legal expenses on sale of $5k.

The margin will be

$1,500,000 – $500,000 = $1,000,000

The GST on the margin will then be $1,000,000/11 = $ 90,909

CAUTION

The consideration for the acquisition of the property is the original purchase price after taking into account settlement adjustments. GSTR 2006/8 paragraph 48.

Paragraph 49 of the same ruling says that the consideration for the acquisition DOES NOT include costs incurred that were associated with their purchase such as legal expenses and stamp duty.

It also does not include any costs in developing the property prior to or after its acquisition.

If you are doing a property development then understanding the margin scheme and how the margin scheme applies is an extremely important part of your feasibility study.

The sale of new residential premises in many cases will be considered to be a taxable supply and the impact of the margin scheme on this supply needs to be considered.

However just because it is new residential premises does not always mean it is subject to GST.

We have applied for a number of Private Binding Rulings for clients where we have successfully argued that GST should not apply to the sale.

This is a very complex area of the tax law so reach out to us if you feel this is an issue for you.

Frequently Asked Questions

The margin scheme is a set of rules that provide an alternative method of calculating the GST on the sale of a property. This scheme might assist in reducing the GST payable on the sale of real property. The ‘margin’ here is not the same as the ‘profit on sale’, as it does not include other costs like subdivision costs, construction costs, etc.

GST applies to a property sale if it’s made for consideration, is in the course of furtherance of an enterprise carried on by the entity making the supply, is connected with Australia, and is made by an entity registered or required to be registered for GST.

Eligibility for the margin scheme depends on the GST treatment when you purchase the property from the vendor. Some complexities arise, particularly where the property has been sold GST-free. Therefore, legal advice is critical in these situations.

Many legal advisors include a clause within the contract to recover GST from the purchaser if it’s discovered that GST is payable. This protects the vendor who would otherwise be responsible for the GST payment.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Optio, neque qui velit. Magni dolorum quidem ipsam eligendi, totam, facilis laudantium cum accusamus ullam voluptatibus commodi numquam, error, est. Ea, consequatur.