2 CRITICAL MISTAKES PEOPLE MAKE WHEN SETTING UP A FAMILY TRUST TO PURCHASE PROPERTY

A common question, and sometimes one of the reasons that clients call me, is to ask

“should I setup a family trust to purchase my next investment property ?”

For many people they have heard of trusts but…

What is a trust ?

I should point out the concept of ‘trusts’ can be very simple to understand, yet

at the same time is also extremely complex.

It takes many years for the concept to ‘sink in’ for most people.

This includes lawyers who all would have taken a subject on trusts during their law

studies, but who may not have any practical experience with trusts.

This is similar for the accountants and financial planners.

Many people speak of trusts as a separate entity, like a company. But this is not

the case; a trust is not an entity, but rather a relationship.

A trust is not a ‘legal person’ and cannot own anything, and therefore it cannot

sue or be sued. It is the trustee who acts for the trust and owns trust

property in its capacity as trustee.

The trust is the relationship between the trustee, the property and the

beneficiaries.

However, for tax purposes, a trust is considered a separate entity

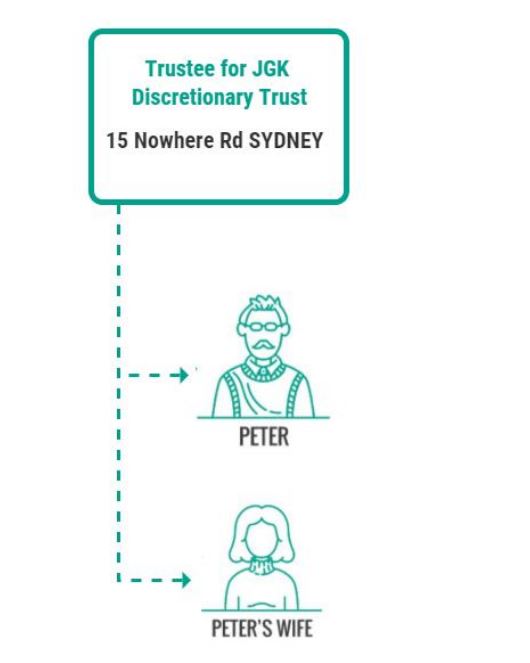

The diagram below illustrates a basic trust relationship holding property

FIRST MISTAKE – IS A TRUST RIGHT ?

A family trust may or may not be the right structure to hold your investment property.

The main reasons for using a trust are the side effects of benefiting the family as a whole and these are:

1. Asset Protection

2. Estate Planning

3. Tax minimisation

Many people think a trust will mean they pay less tax.

It’s important to remember that

1. Family trusts don’t get the benefits of negative gearing. Any losses incurred by the trust must be carried forward to be offset against profits at a later time

2. In some states family trusts do not receive a land tax threshold or the land tax threshold is very low and this can add up significantly over the years

This doesn’t mean however that trust isn’t useful in tax planning. It may be that the trust will allow for the ability to minimise the tax payable on sale.

I have found that the answers are found in tax modelling and discussing the various options with clients.

It continues to surprise me how very few accountants model out the different scenarios.

SECOND MISTAKE – USING ONE TRUST TO HOLD ALL

PROPERTIES.

If the trustee of a trust is sued the assets of the trust can be used to satisfy the liability of the trustee if that debt relates to the trustee’s role as trustee.

This means where a $2 company is trustee of a discretionary trust and a tenant slips and falls and sues the owner of the property, the landlord, they will sue the company and the company will use the trust assets to satisfy the debt.

So if the trustee owns 4 properties within the one trust and the tenant of one property slips and breaks their back the equity in the other 3 properties will potentially be at risk.

However, if there were separate trusts the assets of each trust would be segregated from the other trust.

A potential way to strengthen asset protection is to use multiple entities.

Trusts are complex.

But with the right Property Investment Accountant they can assist you to understand the complexity of trusts and navigate this maze.

If you would like to find out how we can help with your property investments or property developments and whether a trust is right for you the get in touch with us today.

If you are using a trust as part of your property development then consider our article on Structuring Your Development https://www.propertytaxsolutions.com.au/property-development-structuring-property-tax-solutions/

Frequently Asked Questions

A family trust is a legal agreement where the trustee holds and manages assets for the beneficiaries. It is not a separate legal entity, but a relationship between the trustee, the assets, and the beneficiaries. However, for tax purposes, a family trust is treated as a separate entity.

The primary reasons to set up a family trust for property investment include asset protection, estate planning, and tax minimisation. A trust can help secure the family’s assets and ensure they’re passed down effectively. It also provides options for tax planning, although it’s important to note that trusts don’t get the benefits of negative gearing.

While many people believe that a trust can reduce their tax liability, it’s not always the case. Family trusts don’t get the benefits of negative gearing, and any losses incurred by the trust must be carried forward to offset profits later. However, a trust can help in minimising tax payable on sale, depending on individual scenarios.

Two common mistakes include assuming a trust is the right choice for everyone and using one trust to hold all properties. A trust might not be the best choice for everyone, and it’s crucial to evaluate your unique circumstances. If a single trust holds all properties, the equity in other properties can be at risk if a lawsuit arises related to one property.

A Property Investment Accountant can help you understand the complexities of trusts and guide you through the process. They can provide tax modelling and discuss various options to determine the best approach based on your individual needs and goals.